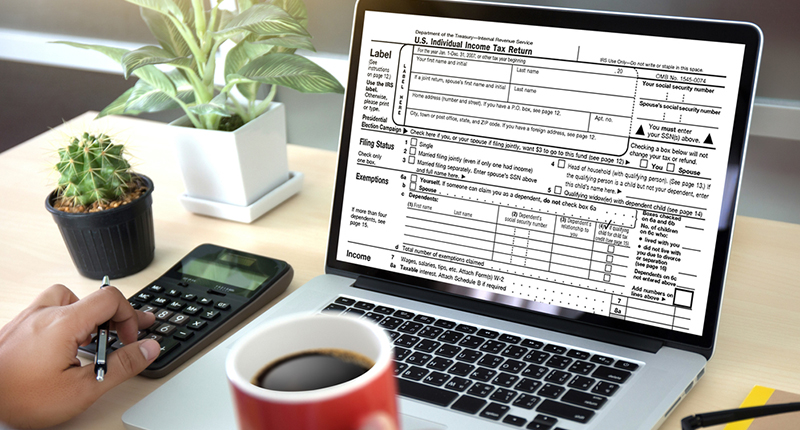

As a result of the pandemic, various internet tax services have sprung up. However, you must exercise caution in order to work with the best. It can be simple if you have a straightforward tax status.

If you have a single employer, then online tax services should be able to file your returns. Also, online tax services are ideal for people who don’t qualify for itemized deductions. One of the best online tax services and pieces of software comes from H&R Block.

Furthermore, you don’t have to be concerned if you have to stroll into one of their offices because it has a number of locations throughout the United States. In this essay, we will look deeper into the advantages of H&R Block.

Online tax services are another option if you’d rather not use a credit card or take money out of your federal refund. Did you know that you can use a credit card to settle your tax bill?

During the pandemic, most people couldn’t walk to tax filing offices that they had used before. Hence the online tax service was born. H&R has a user-friendly and powerful online tax preparation for home filers.

Moreover, it’s free for people whose annual gross income was $69,000 or less, were 51 years old and qualify for earned income tax. All these must apply to when you last filed your returns.

Free Filing Program

What if I told you that H&R has a free tax filing program? It must be exciting. Imagine someone doing all the calculations involved in tax filing for you for free!

However, this free feature is available for a selected group of people and it includes unlimited Free State returns. They are as follows.

- People whose Annual Gross Income (AGI) is $69000 or less in the last year you last filed your returns

- If you were 51 years old in the year you last filed.

- If you qualify for Earned Income Tax credit

This free filing plan is ideal for people that have simple tax situations and those that qualify for subsidies specified in the Affordable Care Act.

However, it doesn’t work for filers with capital losses or gains, self-employment income, ordinary dividends, and interest income, and rental property income.

Another disadvantage is that it doesn’t allow you to access or store past-year returns. If you like to keep or revisit your previous year’s records, then you might consider a paid plan.

It’s available to all American residents in the 50 states and has no restrictions. All filers qualify for free hands-on advice, in-person audit support, and assistance with audit preparation.

In case you don’t get satisfactory results or get stuck, you can access any of the H&R Block offices in your state for in-person assistance. Other features include data security for your online data.

There are also tax experts to help answer any of your questions. Also, they have easy and helpful tools. You can connect instantly with experts using on-demand chat and screen share features.

Cost

H&R Block has a 3-step pricing process. First, determine your base price which fits your life situation. The base price starts at $69. Next is adding a state you have lived or worked in.

Each state is priced at $59. Lastly, choose your add-ons like credits, products, or forms that meet your tax needs.

How to Sign Up

You will need to open an account with H&R Block. Go to their website here to open an account with them. Fill the online form with your valid email, username, and password.

If you already have an account, ignore this page and log in to open your account.

The Bottom Line

With advanced technology and the pandemic effects, most services have moved online. This includes filing tax returns. There are many online tax service companies and software.

You will need to see what each offers, the features, and cost. H$R Block is one with a transparent pricing system. Also, it offers a free program to people with minor tax situations.